Travel Insurance: Why You Need It and How to Select the Best Policy

Travel insurance is often seen as an optional expense for travelers, but it can be a crucial safeguard against unexpected events that can affect your trip. From medical emergencies to trip cancellations, having the right travel insurance can provide financial protection and peace of mind. This article delves into why travel insurance is essential and offers guidance on selecting the best policy to suit your needs.

Contents

Why Travel Insurance is Essential

Financial Protection Against Trip Disruptions

Travel insurance offers financial protection against various disruptions that could impact your trip, including:

- Trip Cancellation: If you need to cancel your trip due to unforeseen circumstances such as illness, a family emergency, or work-related issues, travel insurance can reimburse you for non-refundable expenses like flights and accommodation.

- Trip Interruption: If your trip is cut short due to an emergency or other covered reasons, insurance can provide compensation for unused trip expenses and additional costs incurred.

- Travel Delays: Coverage can include reimbursement for additional expenses incurred due to delays, such as accommodation, meals, and transportation.

Medical Emergencies

Medical emergencies can occur unexpectedly, especially when traveling abroad. Travel insurance can provide:

- Medical Coverage: Coverage for medical expenses incurred due to illness or injury during your trip. This is particularly important if you are traveling to countries with high medical costs or where your domestic health insurance may not provide adequate coverage.

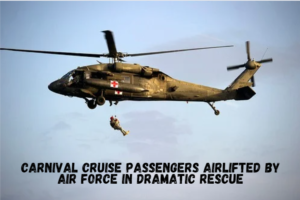

- Emergency Medical Evacuation: If you require evacuation to a medical facility or back home due to a serious condition, travel insurance can cover the cost of transportation and medical care.

Protection Against Lost or Stolen Belongings

Travel insurance can help protect you against the loss, theft, or damage of personal belongings, including:

- Baggage Delay: Reimbursement for essential items purchased if your baggage is delayed.

- Baggage Loss or Theft: Compensation for lost, stolen, or damaged baggage and personal items.

Assistance Services

Many travel insurance policies offer 24/7 assistance services to help with:

- Emergency Assistance: Access to a network of global assistance providers who can help with medical emergencies, travel arrangements, and other urgent needs.

- Travel Support: Assistance with rebooking flights, arranging alternative accommodations, and navigating language barriers.

Peace of Mind

Travel insurance provides peace of mind, knowing that you are protected against a range of potential issues that could disrupt your trip. This peace of mind allows you to focus on enjoying your travel experience rather than worrying about what could go wrong.

How to Select the Best Travel Insurance Policy

Assess Your Needs

Before purchasing travel insurance, assess your specific needs based on factors such as:

- Destination: Consider the destination’s healthcare system and potential risks. Countries with high medical costs or limited healthcare facilities may require more comprehensive coverage.

- Trip Duration: The length of your trip can affect coverage needs and costs. Longer trips may require more extensive insurance.

- Activities: If you plan to engage in high-risk activities such as skiing or scuba diving, ensure your policy covers these activities.

- Health Conditions: Pre-existing medical conditions should be reviewed to determine if they are covered by the policy or if additional coverage is needed.

Understand Coverage Options

Travel insurance policies can vary widely in terms of coverage options and limits. Key areas to consider include:

- Trip Cancellation and Interruption: Coverage for non-refundable expenses and costs incurred due to trip interruptions.

- Medical Coverage: Limits on medical expenses, including emergency medical care and evacuation.

- Baggage and Personal Belongings: Coverage limits for lost, stolen, or damaged baggage and personal items.

- Emergency Assistance: Access to emergency assistance services and support.

Compare Policies

To find the best policy for your needs, compare coverage options and costs from multiple insurance providers. Consider using comparison websites or consulting with insurance brokers to find the most suitable options.

Read the Fine Print

Carefully review the terms and conditions of the policy, paying attention to:

- Exclusions: Understand what is not covered, such as certain activities, pre-existing conditions, or specific events.

- Coverage Limits: Be aware of the maximum coverage limits for different types of claims and expenses.

- Deductibles: Review any deductibles or out-of-pocket expenses that may apply.

Check for Additional Benefits

Some policies offer additional benefits that can enhance your coverage:

- 24/7 Assistance: Access to a global assistance network for emergencies and support.

- Travel Delay Coverage: Compensation for additional expenses incurred due to travel delays.

- Rental Car Coverage: Coverage for rental car damage or theft.

Purchase Early

It’s advisable to purchase travel insurance as soon as you book your trip. This ensures that you are covered for any potential issues that may arise before your departure, such as trip cancellations or changes in travel plans.

Review and Update

Review your travel insurance policy before each trip to ensure it meets your current needs. Update your coverage if necessary, especially if your travel plans or health conditions change.

Conclusion

Travel insurance is a vital investment for protecting yourself and your finances while traveling. By understanding the importance of travel insurance and carefully selecting the best policy for your needs, you can enjoy your trip with confidence, knowing that you are protected against a range of potential issues. Assess your needs, compare policies, read the fine print, and purchase early to ensure comprehensive coverage and peace of mind during your travels.

Post Comment